Provident Fund

Employees’ Provident Fund Act – Overview and Compliance Guide

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 ("EPF Act") is a central legislation aimed at providing social security to employees in the form of a retirement benefit. The Act mandates a savings scheme in which both the employer and employee contribute to a provident fund account maintained by the Employees’ Provident Fund Organisation (EPFO)

Applicability of the EPF Act

-

Establishments employing 20 or more persons.

-

Specified industries listed in Schedule I of the Act, or any other notified establishment.

-

Once applicable, the Act continues to apply even if the number of employees falls below 20.

-

Voluntary coverage is available for establishments with fewer than 20 employees, subject to approval by the EPFO.

Employees Covered

-

All employees drawing wages up to ₹15,000 per month are mandatorily covered.

-

Employees earning above ₹15,000 can be enrolled voluntarily with mutual consent of employer and employee.

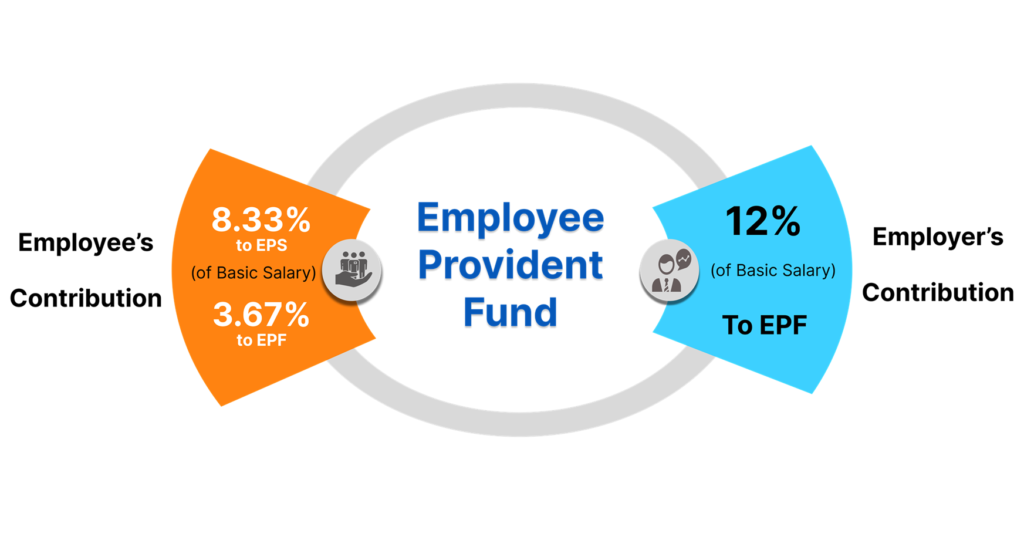

Rate of Contribution

Under the EPF Scheme, 1952, the current contribution rates are:

| Party | Contribution (%) | On Wages |

|---|---|---|

| Employer | 12% | Basic + DA + Retaining Allowance |

| Employee | 12% | Basic + DA + Retaining Allowance |

Note: For certain industries like jute, beedi, brick, etc., the employer's contribution is 10%. The employee continues to contribute 12%, unless notified otherwise.

Out of the Employer's 12% contribution:

-

8.33% goes to the Employees’ Pension Scheme (EPS) (subject to a cap).

The balance goes to the Employees’ Provident Fund (EPF).

Due Dates for Compliance

| Compliance | Due Date | |

|---|---|---|

| EPF Contributions Deposit | On or before 15th of the following month | |

| Filing of ECR (Electronic Challan-cum-Return) | Monthly, before 15th of each month | Inspection Book Pf |

Consequences of Non-Compliance

Failure to comply with the provisions of the EPF Act can lead to the following:

A. Penal Damages (Under Section 14B)

For delayed remittance of contributions:

| Delay Period | Damages | ||

|---|---|---|---|

| < 2 months | 2–4 months | 4–6 months | > months |

| 5% p.a. | 10% p.a | 15% p.a. | 25% p.a. |

Other Penalties

-

Imprisonment up to 1–3 years and/or fine up to ₹10,000 for default in payment.

-

Prosecution of the employer and responsible officers.

-

Attachment of bank accounts, property, and arrest in extreme cases.